Secure a Tax-Free Retirement with Compound Interest

Learn How An IUL Can Create Tax-Free Wealth

— With Zero Market Risk

Are You Self-Employed and 100% Responsible for Your Retirement?

If you're a business owner, freelancer, or entrepreneur, you don’t have the luxury of a company-sponsored 401(k) or pension. You're responsible for building your own future — and Indexed Universal Life Insurance (IUL) could be the smartest move you’ll ever make.

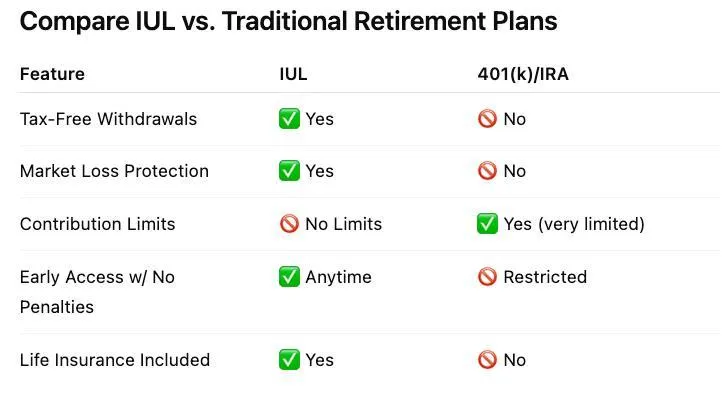

Tax-Free Retirement Income

Withdraw your money tax-free in retirement — like a Roth, but with no contribution limits.

Flexible Access to Cash

Access funds at any time without age restrictions or penalties.

Protection from Market Losses

Unlike the stock market, your cash value never drops due to downturns.

Life Insurance with Living Benefits

Get coverage now and financial peace of mind later.

Why Self-Employed Professionals Are Choosing

IUL for Retirement

Many self-employed professionals are turning to Indexed Universal Life Insurance (IUL) because they’re tired of the uncertainty.

What Makes IUL Ideal for

Self-Employed Business Owners?

✅ "A business owner needs life insurance to cover their business debt and to provide for their family if he or she were to die. Therefore, owning a life insurance policy is not an extra, but rather something that should be a standard part of every business owners portfolio."

✅ "The reason permanent life insurance (IUL) is so much more appropriate than term life insurance in this particular circumstance is because many business owners will live longer than a term policy will stay in existence. If they outlive the coverage, it does them no good. Not only will they have wasted a lot of money in premium, but they will have nothing to show for it.

~ Patrick Kelly, author of Tax-Free Retirement

Build Wealth, Live Free, Leave a Legacy That Lasts Generations

An Indexed Universal Life Insurance (IUL) policy isn’t just a retirement strategy—it’s a powerful tool to leave a lasting legacy. While you grow your wealth tax-free and protect it from market losses, your IUL also ensures that your loved ones are financially secure when you're gone.

The death benefit passes to your heirs tax-free , creating generational wealth without probate delays or legal complications. Unlike traditional retirement accounts, an IUL gives you both living benefits and a guaranteed legacy. It’s peace of mind now, and protection for those you love later. Secure your future—and theirs—by planning your legacy today.

Tax-Free Growth

With an IUL, your money grows tax-deferred and can be accessed 100% tax-free in retirement. No capital gains, no income tax, no penalties—just pure, flexible income when you need it most.

Zero Market Risk

An IUL protects your money from market downturns. When the market rises, your cash value grows—when it falls, you don’t lose a cent. Say goodbye to sleepless nights over stock market crashes.

Penalty Free Access

Unlike traditional retirement accounts, an IUL lets you access your money tax-free and without early withdrawal penalties. Use your funds when you need them—no age restrictions, no IRS rules, just freedom.

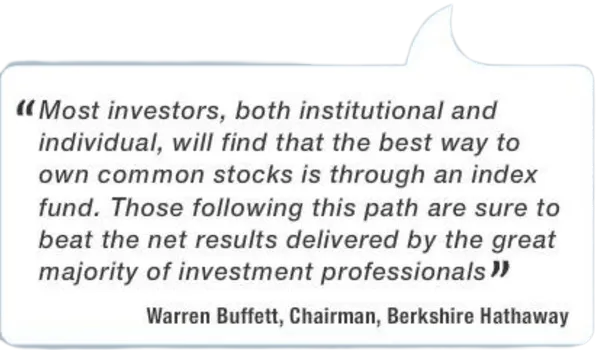

Experts Have Spoken!

Achievements and Impact

Frequently Asked Questions

Q: Is an IUL right for my income level?

A: Most self-employed individuals earning $75k+ annually can benefit from IUL’s tax and growth advantages.

Q: What if I already have a retirement account?

A: IUL can complement your existing plans, reduce tax exposure, and provide more flexibility.

Q: How much do I need to get started?

A: You can start with as little as a few hundred dollars per month — it’s flexible and tailored to your situation.

Ready to Take Control of Your Retirement?

Get the Benefits of Indexed Universal Life Insurance — Without the Complexity

What Our Clients Say

Our clients are at the heart of everything we do. We are proud to have helped individuals and families achieve financial security, build wealth, and plan for the future with confidence. Our commitment to personalized service and expert guidance has earned us the trust of clients who value a partner that truly understands their unique financial goals. Here’s what some of our satisfied clients have to say about their experiences with our company and how we’ve made a difference in their financial journeys.

Ethan Parker

"As a small business owner, I had no idea how powerful an IUL could be for my retirement planning. Working with your company opened my eyes. You made the process simple, and now I have a tax-free strategy in place that protects my future and my family. I’m honestly shocked more people don’t know about this!"

Marcus Bennett, MD

"I’ve worked with other financial advisors before, but none explained the benefits of an Indexed Universal Life policy like your team did. They broke it down in plain English and helped me set up a plan that gives me peace of mind. The flexibility, tax advantages, and living benefits were exactly what I needed."

Lauren Mitchell

"I came in skeptical, but after seeing how much control an IUL gives me over my retirement income, I was sold. These guys really know their stuff and were patient with every question I had. I’ve got tax-free growth now, and I’m no longer worried about market crashes wiping out my savings."

Julian Ramirez

"I was looking for a smarter way to save for my kids’ college and my own retirement. Your company helped me understand how an IUL could do both—and without all the risk of the stock market. The support and clarity you provided were incredible. I finally feel like I’m on the right path."

© 2026 William Noel - All Rights Reserved.